Mark Iverson on his excellent blog recently posted that he had got as bit careless and thus his March was in a nasty red place.

He went on to outline his plan for recovering these losses and keeping his long running streak of green months going.

I read the article and thought that he sounded sensible and stable, as you’d expect from a full time trader who has such a great record. Others saw things slightly differently. One comment in particular which made me think is pasted below:

“Not the most ‘professional’ thing to do, looking at your pnl in short periods, just as bad as setting a daily limit to be fair.”

Now i understand that being profitable over 1, 3 or 5 months does not necessarily guarantee long term success, but i do think that keeping a close eye on pnl on a daily basis can help maintain focus and discipline.

I am not condoning setting a daily limit as which you stop trading, because obviously some days there will be more opportunities than others, but take my situation for instance; I have set my self a target bank that i think i can realistically reach come the end of the year. From this, I have then seen what % of my bank i need to achieve each day in order to keep in line with this target. I may be opening myself up to mockery here, but i find that it helps me to bank those smaller greens and plod along nicely.

Small, achievable goals, whether they are monthly, weekly or daily can help less experienced traders, and i think it just varies from person to person. As long as when the inevitable happens and you under perform one day, you don’t panic.

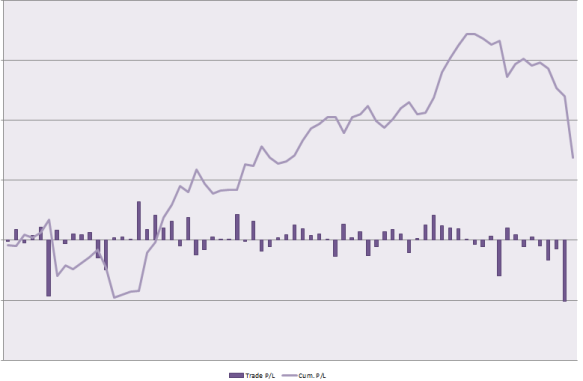

At the end of February I found myself in a very familiar position, with a big red month having started 2012 well. The amount lost could not be sensibly retrieved in a month or two, but as long as it is eventually clawed back i’m not bothered. Setting up a ‘projected’ bank in excel has helped me to realistically place when i can expect to be back level, which has helped to calm me down and focus on each trade individually, irrespective of my current bank.

On a tennis related note, I watched the battle of the Marias last night and was disgusted by Kirilenko. She played excellently, especially for the 1st set and a half, but the tennis authorities inability to control the stars of the game reared its ugly head again. Once Sharapova had regained momentum in the 2nd set after a marathon game where she saved 6 BPs, Kiri called for a trainer for no apparent reason. Got some strapping applied and broke up the pace of the game. Cheating.

She then was penalized for tapping her racket on the ground 3 times mid point and launched a volley of abuse at the umpire, who by all accounts was spot on with her judgement. She went on to win the game and directed her screams of victory straight at the official. Disgraceful.

Then after having lost the 2nd set, she took about 5 minutes before deciding she needed a comfort break (seemingly to change dress and redo her hair), before emerging for the 3rd set very very late.

This whole match was riddled with players taking up to 50% longer than the time they are allowed between each point, and by the end i felt like id barely seen any tennis. The 2nd set alone lasted 94 minutes, without even a TB! I didn’t enjoy it as much as i should have considering the level of tennis being played, which was exceptionally high from both ladies.

The powers that be need to step in, and stop letting the players do what they want. It gets worse every year, and all it would take is for a couple of time penalties to actually be imposed- during a big match – to straighten these brats out.

That’s all! Enjoy the weekend.